By MERLION$ | Merlion Finance

💼 Company Snapshot

Alibaba Group Holding Limited (NYSE: BABA) is more than just China’s answer to Amazon – it’s an entire ecosystem of e-commerce (Taobao, Tmall), cloud computing (Alibaba Cloud), fintech (Ant Group), logistics (Cainiao) and entertainment. Founded in 1999 by Jack Ma, the company grew into a global tech juggernaut.

In recent years the glow faded somewhat: regulatory crackdowns, slow consumer recovery, and global trade pressure dampened investor enthusiasm. Now in late 2025, the narrative is shifting again.

💸 Fundamental Check – What the Numbers Say

| Metric | Latest Estimate (Nov 2025) | Notes |

|---|---|---|

| Share price | ~ $160 – $170 USD (for BABA) Twelve Data+1 | Much higher than last-year troughs |

| P/E Ratio | ~ 20x (varies by source) Investing.com+1 | Still modest for a large tech company |

| Free Cash Flow / Balance Sheet | Strong liquidity buffer reported | Indicates world-class capital position |

| Growth narrative | Cloud/AI, international expansion, share buybacks Investopedia+1 | Big bets on future growth |

The takeaway: Alibaba is trading at valuation levels that suggest “value tech” rather than “high-growth unicorn,” but the underlying business remains massive and resilient.

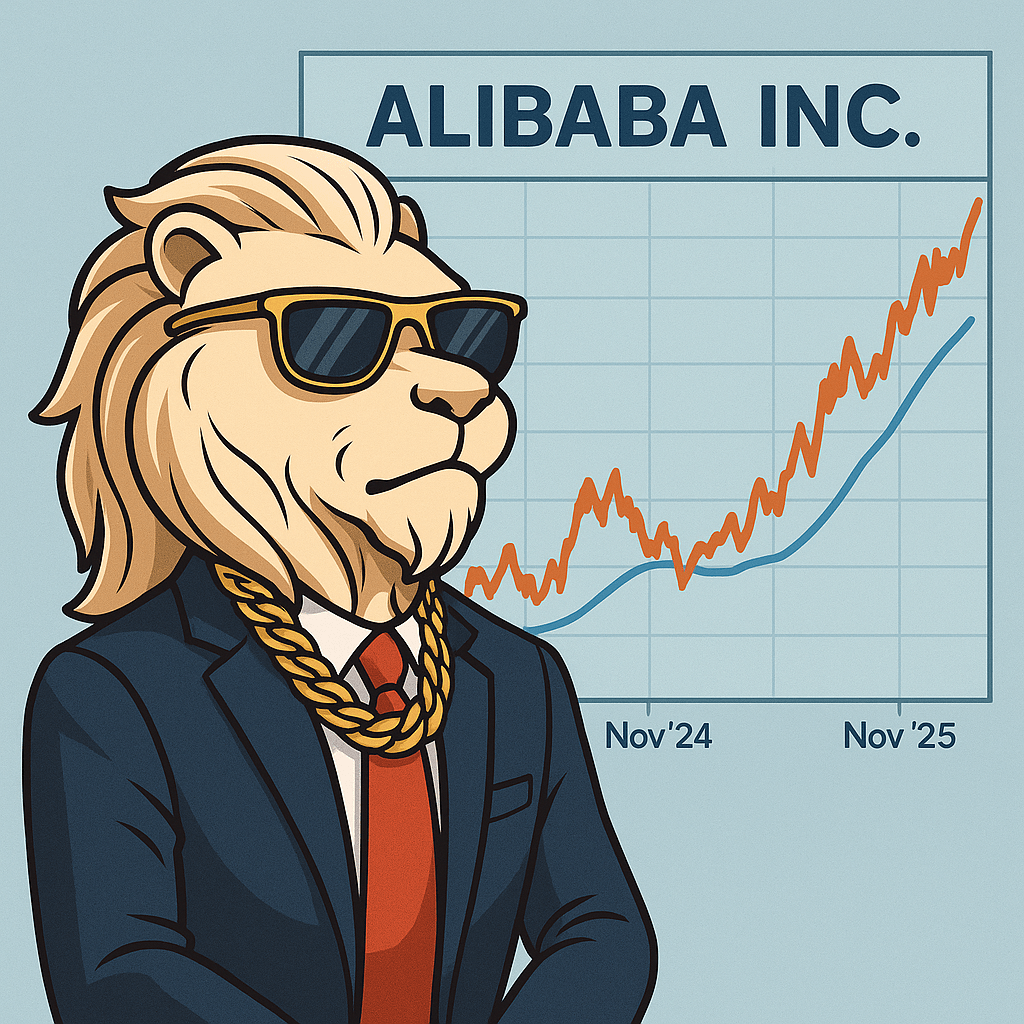

📉 Technical Map – November 2024 to November 2025

Let’s delve into how the chart has been behaving and what signals appear.

🕒 Price Movement

- End of 2024: Alibaba was roughly in the range ~US $80–100 according to historical data. Digrin+1

- Mid-2025 rally: The price climbed through the ~$110-140 region as sentiment improved and growth signals returned. StockAnalysis

- Nov 2025: Trading around US $160–170 (for example ~$165.89 as of Nov 10) Macrotrends+1

- The stock appears to have built a base, recovered significantly, and is now consolidating.

📊 Key Indicators (observational)

- RSI (Relative Strength Index): Appears to have moved from oversold regions (early 2025) toward mid-range ~45-55 now – suggests neutral momentum. Investing.com

- MACD (Moving Average Convergence Divergence): During the rally phase the MACD likely crossed bullish; currently the histogram looks flattened, pointing to consolidation rather than steep trend.

- Volume behaviour: In the earlier parts of the year, volume peaked during the rally. Now volume is quieter, which suggests accumulation rather than mass sell-off.

- Support & Resistance Zones:

- Strong support: ~$120–130 region (where stock spent time)

- Near-term resistance: ~$180–190 region (recent highs)

- A breakout above ~$190 with good volume could suggest next leg; failure might mean sideways movement.

🧭 Pattern Summary

The weekly timeframe shows what could be a rounded bottom / accumulation phase. The smart money may be creeping in. For long-term investors, this consolidation after a sharp rally may indicate a more stable upward base forming – provided fundamental drivers hold.

🧠 My View: Opportunity + Caution

Opportunity:

- At ~$160-170 USD, you are buying a company with genuinely global scale, solid cash flows, and operate in a major growth market (China tech + cloud).

- If you believe China tech rebounds and Alibaba executes on cloud/AI/international expansion, the upside is real.

- Add in share buybacks and a leaner corporate structure, and you have value-tech underpriced.

Caution:

- Macro / geopolitical risk remains – things like U.S./China trade, domestic regulation, consumer slowdown.

- The stock already had a strong recovery from lows – risk of consolidation or pull-back is real.

- If you’re thinking short term (3-6 months) you might be disappointed; this one demands multi-year hold.

Time horizon:

- This is a 5-7 year play, not a quick flip. If you’re only in for weeks, you’re chasing noise.

- If you can hold through volatility and ignore the daily ticker, you might win.

🧘♂️ “The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

📜 Disclaimer:

This article reflects personal opinion only. It is not financial advice. Do your own research, check your risk tolerance, and invest only capital you’re prepared to lock away for the long haul.

Stay rational. Stay ballin’. 🦁

– MERLION$ | MerlionFinance.com

Leave a comment